The equity premium puzzle proposed by Mehra and Prescott (1985) refers to the shortcoming of asset pricing models to capture the premium of average US equity portfolio returns (stock returns) over US Treasury bill rates (risk free returns). Although there have been a plethora of research efforts to solve the equity premium puzzle, only a few studies have examined the role of the labour market. In this context, George and Alba (2020) compare the performance of different forms of wage inertia in capturing the dynamics of dividend and equity risk premium.

Traditionally, asset-pricing literature has revolved around the assumption of a frictionless labour market where wages are equal to the productivity of labour. As the determination of wages is crucial to assessing the value of a firm, this assumption has far-fetching implications on determining the value of the firm. Most of the existing studies that examine the role of wage inertia in asset pricing consider wages to be exogenously sticky, or wage inertia to be endogenously determined through Nash Bargaining. With this in mind, George and Alba (2020) incorporate a different kind of wage inertia through alternate offer bargaining framework in a production-based asset pricing model.

A motivation for this study stems from the recent findings in macroeconomics that labour market models utilising the Alternate Offer Bargaining (AOB) framework can account for key properties of labour and macroeconomic variables found in the data. With their research, George and Alba address the idea behind using alternate offer bargaining in macroeconomics, and question whether the same approach can be used to understand asset pricing puzzles.

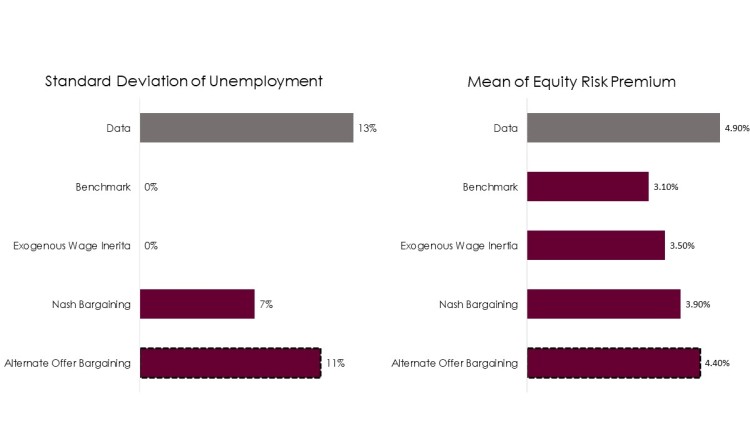

George and Alba (2020) compare the performances of different kinds of wage inertia to find that the AOB model brings the equity premium moment very close to its data counterpart. As the AOB model is able to account for key volatilities in the labour market, the long run risk increases under an AOB framework. In other words, periods of economic downturn are associated with relatively higher levels of unemployment, so there is a fear of being unemployed and being limited to the lower payment of unemployment benefits instead of wages. Such a fear of cashflow risk causes agents to demand higher equity premium.

By Ammu GEORGE and Sunena GUPTA