Summary:

Rising geopolitical fragmentation has reshaped China’s outward foreign direct investment (OFDI) post-pandemic. While China’s OFDI contracted broadly during the pandemic years, this decline coincided with pronounced regional and sectoral reallocation. Recent ACI research shows that Chinese OFDI has increasingly shifted toward ASEAN, with investment becoming more concentrated in industries aligned with China’s national interests and industrial upgrading objectives, such as semiconductors and motor vehicles. We argue that the reconfiguration of Chinese OFDI is consistent with Chinese firms’ efforts to bypass trade barriers, strengthen supply-chain resilience, and preserve and expand global market access.

Highlights:

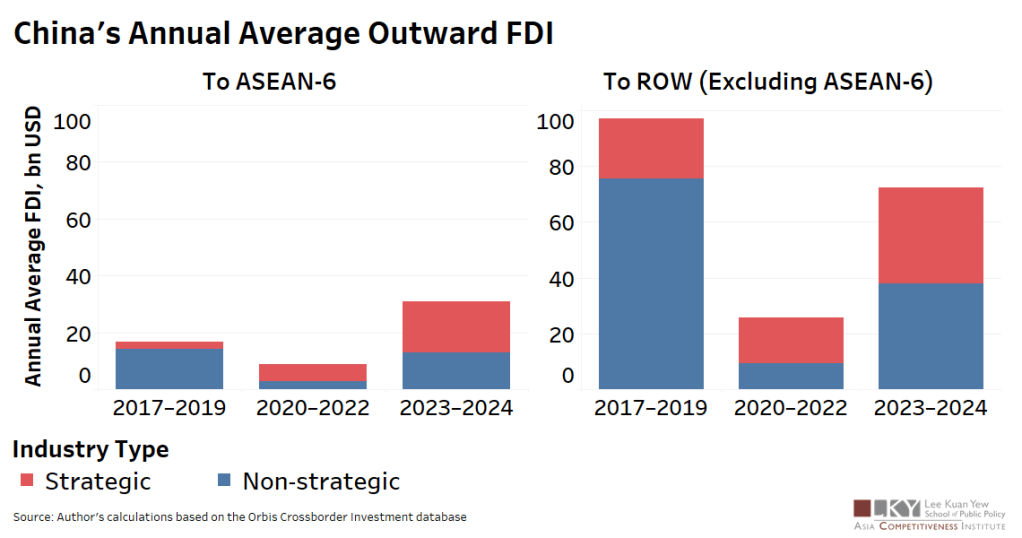

1. China’s OFDI contracted during the pandemic, but with sharp regional and sectoral divergence. From 2020–2022, total OFDI to ASEAN-6 and ROW fell by about 50% and 70%, respectively, yet strategic OFDI to ASEAN-6 nearly tripled and proved more resilient than non-strategic OFDI in ROW.

2. Strategic sectors drove the post-COVID recovery of China’s OFDI. In 2023–2024, strategic OFDI to ASEAN-6 reached nearly eighttimes its pre-COVID level, while strategic OFDI to ROW recovered to about twice its pre-pandemic scale.

3. ASEAN-6 has emerged as a key relocation hub for China’s strategic OFDI. Its share of China’s strategic OFDI rose from roughly one-tenthbefore COVID to nearly one-third afterward.

4. China’s post-COVID OFDI reflects geographic reallocation rather than overall expansion. While total OFDI returned to roughly pre-pandemic levels, ASEAN-6’s share increased from about 15% to nearly 30%, as OFDI toward ROW recovered more slowly.

Article By LU, Weilin

Graphic By YAN, Bowen