Two decades after the US–Singapore Free Trade Agreement (USSFTA) came into force, one question stands out: what is the impact of foreign direct investment (FDI) from the United States on Singapore’s economic development? New research from the Asia Competitiveness Institute takes stock of the bilateral investments between the two countries and provides robust evidence that US FDI has positively contributed to the growth especially in the manufacturing and wholesale and retail trade sectors. The research further points to where future collaboration may lie for Singapore to further strengthen its investment relationships with states within the US and with partners outside the US.

FDI is shaping value creation in key sectors

Singapore’s economy relies far more heavily on value added generated by foreign-invested enterprises (FIEs) than the global average. During the 2008–09 financial crisis, activities involving these firms gained share in Singapore’s value-added composition, while other economies saw theirs fall. The implication is straightforward: foreign investment is not just an input — it is a shock absorber for the city-state.

Across the economy, foreign-invested enterprise-linked global value chain (GVC) activities account for nearly 40 percent of Singapore’s value added — far above other countries. Within these flows, four industries stand out:

- Wholesale and retail trade

- Finance and insurance

- Computer, electronic and optical products

- Pharmaceuticals, medicinal chemical and botanical products

Notably, pharmaceuticals’ value-added share rose sharply after the USSFTA was signed, suggesting the agreement’s pro-investment provisions and intellectual property (IP) provisions catalysed high-value activities.

The US is the top investor — and invests differently

Project-level data show the United States as Singapore’s dominant source of inward FDI, particularly through greenfield investments — the type that builds new capacity and creates jobs. By contrast, emerging-market investors tend to acquire existing assets via mergers and acquisitions. For Singapore, this distinction matters: greenfield projects are more likely to transfer technology, build capabilities, and deepen economic linkages.

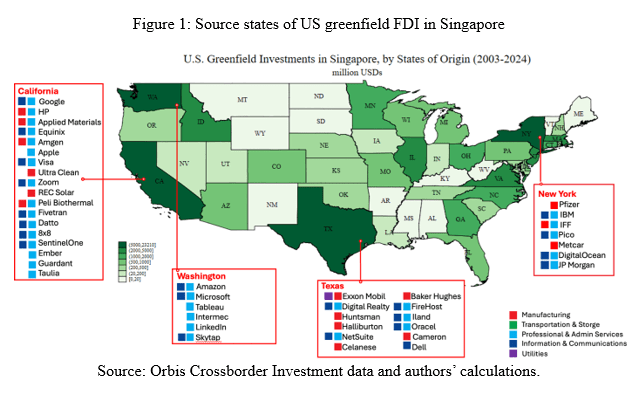

For greenfield FDI in Singapore, the top investor states within the US include California, Washington, New York, and Texas. Investments from the former three focus on professional and administrative services, while Texas firms invested more in manufacturing. To attract investments in regional headquarters function, collaboration with Democratic-led states like California, New York, Massachusetts, and Washington is key. For R&D centers, top investor states include California, Texas, Illinois, North Carolina, Ohio, and Florida—many are Republican-led. This points to a diversification strategy that could target segments — not just geographies. It’s not just about attracting investment from more places, but about focusing on the right kinds of activities those investors bring.

From FDI to Growth

Increasing greenfield FDI from the US brings about new job opportunities. Cumulating from 2003 to 2024, US greenfield FDI projects directly created around 180,000 positions based on Orbis projections, with manufacturing FDIs accounting for nearly 90,000 jobs and professional and administrative services FDIs contributing about 60,000. The most pronounced growth periods include 2006-2007, after the signing of USSFTA.

To put these job numbers into perspective, projected number of jobs associated with US investment in the manufacturing, professional and administrative services, and information and communications sectors represent about 18%, 11%, and 7% of the total official employment numbers as of 2024 in the respective sectors.

Beyond job creations, the authors also find that US FDI, especially in the wholesale and retail trade and manufacturing sectors, has positively impacted Singapore’s sectoral GDP growth.

Bottom line

Foreign direct investment does more than add capital to Singapore’s economy — it builds capabilities, anchors high-value manufacturing, and dampens the impact of global shocks. The USSFTA’s investment-protection, alongside IP-protection architecture, remains a strategic asset, which has shaped and will continue to shape Singapore’s economic resilience and future growth.

Amid recent trade headwinds, the authors further argue that it is important for Singapore to continue strengthening investment ties with the US, while remaining open to expanding partnerships with economies such as the EU, Japan, South Korea and Taiwan in advanced manufacturing and key services sectors like regional headquarters and R&D centers, which will be crucial to bolstering its competitiveness.

By LIU, Jingting

Researchers: LIU, Jingting, LU, Weilin