Summary:

In 2024, the global economy has shown signs of recovery following the significant challenges of 2023, which included energy and food disruptions, high inflation, and tight labour markets. In line with this global recovery, Indonesia achieved economic growth at 5.03%, driven by strong household and government spending, particularly as the country held both presidential and local executive elections during the year. Government efforts to maintain price stability, eradicate poverty, reduce stunting and boost investment further contributed to this resilience.

The 12th edition of our analysis examines the competitiveness of the 34 sub-national Indonesian economies. According to the latest provincial rankings, the top positions were largely dominated by Java provinces, with East Kalimantan being the only non-Java province to secure fourth place. Despite this disparity, significant progress has been made among non-Java provinces, narrowing the gap between the top- and bottom performing provinces by 2024. This improvement is mainly due to improvements in the Government and Institutional Setting and Macroeconomic Stability environments. Among Sumatra provinces, Aceh has seen notable improvement, particularly in Quality of Life and Infrastructure Development, while West Sumatra experienced the largest ranking jump in Government and Institutional Setting. This edition also includes a case study of three provinces—Aceh, North Sulawesi, and Papua—each addressing key challenges that hinder their economic competitiveness.

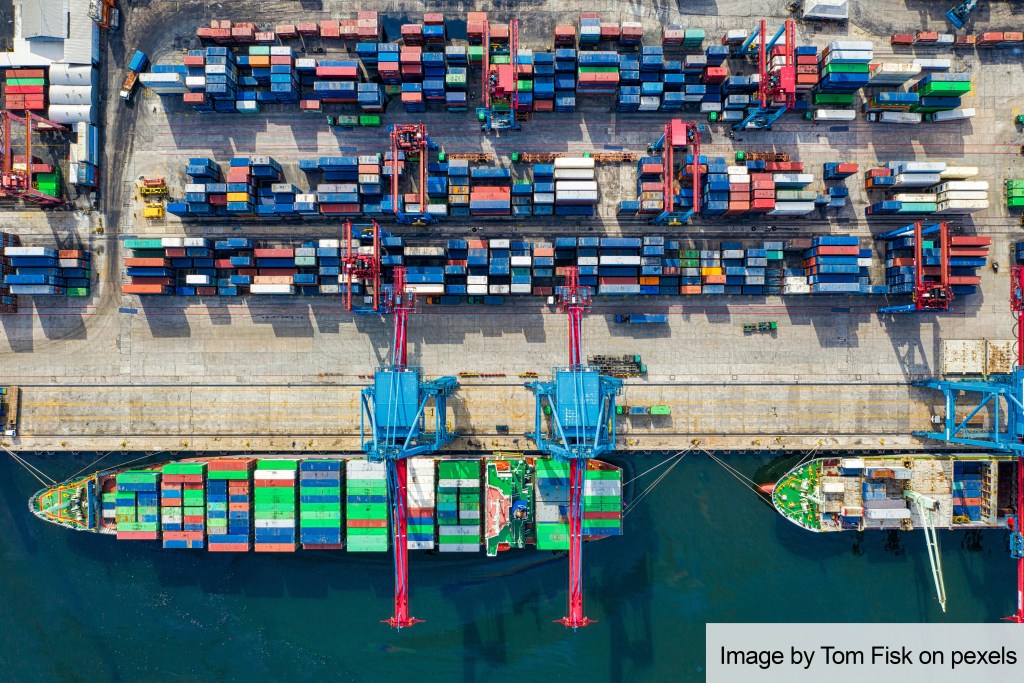

Thematic research for this edition focuses on the significance of maritime shipping and port development for Indonesia as an archipelagic country. Indonesia has lagged in port development, as reflected in low shipping volumes and uneven growth. By integrating our flagship provincial competitiveness analysis with detailed trade and shipping data—using West Kalimantan as a case study—we highlight the province’s comparative advantage in rare earth elements and minerals. However, most shipping activity in West Kalimantan remains domestically oriented, with raw materials transported to manufacturing hubs in other parts of Indonesia, such as Java and the Riau Islands. The study concludes with policy recommendations to improve transportation infrastructure, strengthen local value chains, and invest in workforce upskilling and reskilling to fully unlock regional economic potential.

By NG, Wee Yang