Summary:

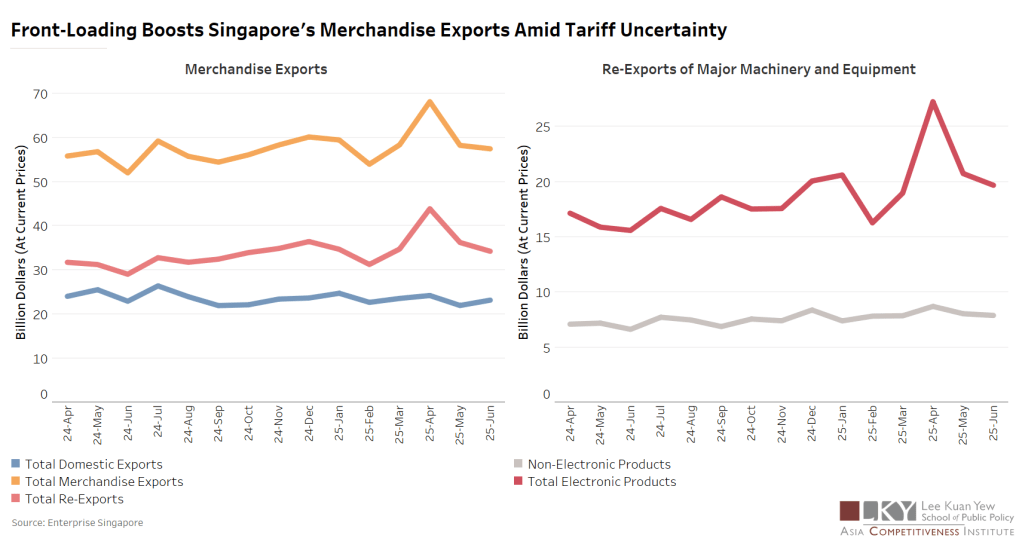

Singapore’s merchandise exports surged in April 2025, driven primarily by a sharp increase in re-exports, reflecting front-loading activities in anticipation of newly imposed tariffs in key markets. Total merchandise exports rose above $68 billion in April – the highest in over a year – before moderating in May and June.

This spike is mainly driven by re-exports, which reached over $43 billion in April. A closer look at the data shows that re-exports of major machinery and equipment — particularly electronic products — surged sharply, suggesting that firms accelerated shipments to avoid higher U.S. tariff rates that were announced in April. Non-electronic re-exports, in contrast, saw a more muted increase, reinforcing the role of electronics in Singapore’s re-export profile.

This front-loading episode reflects Singapore’s strategic position as a global trading hub, where tariff changes abroad can significantly influence trade flows. While the April surge provided a temporary lift to export values and likely supported Q2 GDP growth, the subsequent drop in May and June points to an unwinding of front-loading. In the second half of 2025, Singapore’s economy is expected to feel the impact of the U.S. tariffs and the fading boost from front-loaded shipments.

Highlights:

1. Singapore’s merchandise exports rose above $68 billion in April 2025 – the highest in more than a year – fuelled by front-loading ahead of new U.S. tariffs.

2. Re-exports of major machinery and equipment, especially electronics, led the surge, while non-electronic re-exports saw only modest gains.

3. The April export surge likely lifted Q2 GDP, but fading front-loading and the impact of U.S. tariffs could weigh on Singapore’s economy in the second half of 2025.

Article By NG, Wee Yang

Graphic By YAN, Bowen