The advent of E-commerce has transformed traditional businesses, stirring significant labour market dynamics across many industries. While brick-and-mortar stores are facing heightened competition from online sales, higher demand from the proliferation of e-commerce is expanding job opportunities in traditional sectors like manufacturing and logistics, as well as emerging sectors like software engineering and financial technology. New research from the Asia Competitiveness Institute presents the employment impact of e-commerce across industries in Singapore and across countries of ASEAN-6.

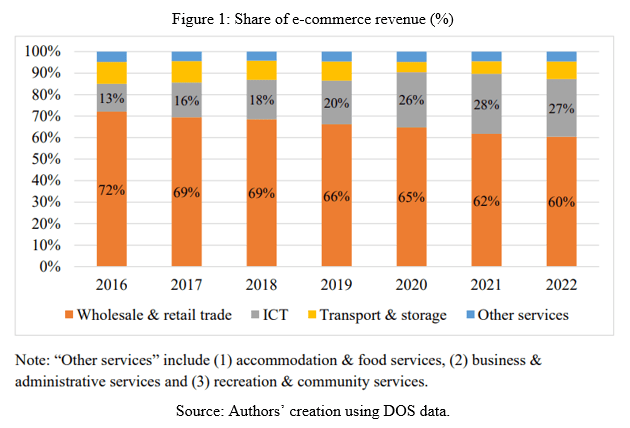

ASEAN has emerged as one of the most promising e-commerce markets globally due to a high degree of internet penetration, a burgeoning middle class, and mobile-first consumer behavior. In Singapore, e-commerce revenues grew from S$173.3 billion in 2016 to S$401.1 billion in 2022, with the highest revenue-generating industries being Wholesale & Retail trade, followed by Information & Communications technology.

The interconnectedness of industries through input-output linkages creates cascading employment effects as e-commerce grows. Using Leontief Inverse Matrix and employment multipliers, ACI’s study estimates that in 2022, over 1 million jobs across all industries in Singapore were supported by e-commerce activity. Of these, 72% were directly employed in core e-commerce industries, while the remaining 296,000 were indirectly engaged by input-supplying industries. As e-commerce expands, this inter-industry integration has been steadily growing, with the indirect employment share going from 26.8% to 28% between 2016 and 2022. Since macroeconomic data is anchored to 2019, any changes in relative shares cannot be attributed to structural changes in the production networks.

While wholesale & retail trade is the biggest contributor to e-commerce-related employment, the second-placed ICT exhibited the highest indirect share among all industries in 2022. On further inspection, the study finds that there is a considerable input-output linkage between wholesale & retail trade with transport & storage, business & administration services and recreational & community services, underscoring the e-commerce industry’s reliance on efficient logistics and customer services. Concurrently, non-e-commerce industries like manufacturing and finance also benefited from spillover effects, gaining over 63 thousand new jobs.

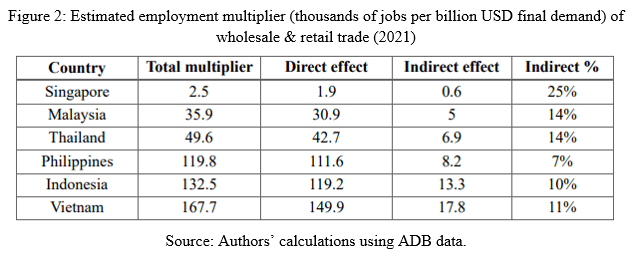

Singapore’s compact and deeply interconnected service industries multiplied the employment impact of e-commerce’s rise. But significant variations exist in the economic structures and labour markets across Southeast Asia, influencing the employment impact of e-commerce on a country level. In this case, due to data constraints, e-commerce demand shocks are imputed using wholesale & retail trade revenues.

Other ASEAN-6 countries, namely Malaysia, Thailand, Philippines, Indonesia, Vietnam, have higher total employment multipliers due to the labour-intensive nature of their wholesale & retail trade industries, but lower indirect share compared to Singapore.

Even the sectoral composition of their indirect shares differs, Singapore’s service-oriented economy and advanced technological infrastructure foster robust synergy among wholesale & retail trade, transport & storage, and finance industries. In contrast, the wholesale & retail trade industry in other ASEAN-6 economies is less efficient and more entangled with primary and secondary sectors, signifying the relative underdevelopment of modern tradeable services. However, weakening linkages between this pairing have been observed between 2016 and 2021 levels.

While these estimates represent upper bounds of employment effects due to modelling limitations, the results highlight the need for the workforce to adapt to economic restructuring. With an evolving services sector, Singapore workers need skills upgradation to capitalise on opportunities in ICT, finance, and professional services. Other economies in Southeast Asia should focus on boosting workers’ digital participation along with developing associated infrastructure to facilitate the transition towards higher-value-added economic activities in the digital era.

Researchers: YAN, Bowen, NG, Wee Yang, XIE, Taojun