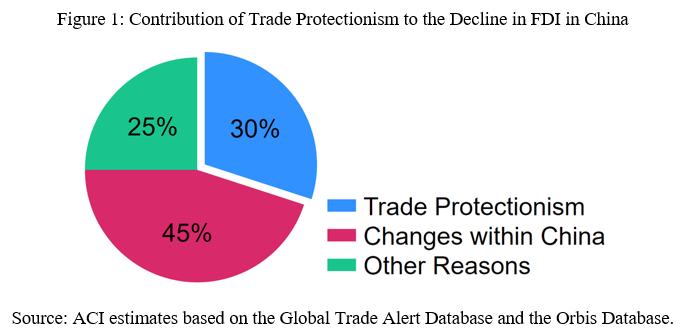

China has experienced a 60-percentage point drop in greenfield FDI from 2018 to 2022, according to ACI’s estimates using the Orbis Crossborder Investment Database. This decline has coincided with rising trade protectionism across the globe. ACI’s latest study has shown that 30% of the observed decline in FDI can be attributed to protectionist measures, 45% to internal changes within China, and the remaining 25% to other factors (Figure 1).

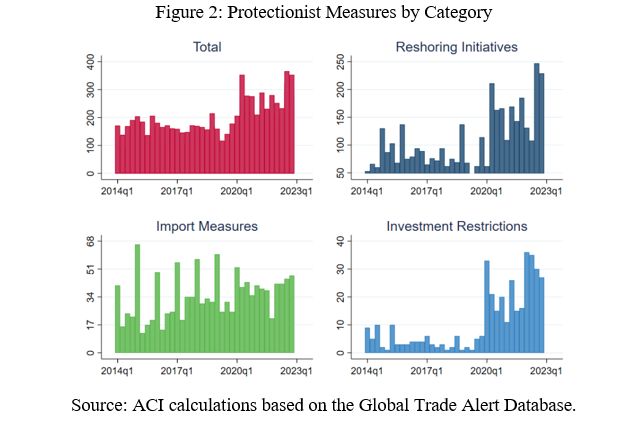

Using data from the Global Trade Alert Database, the research first characterized the landscape of global trade protectionism. In particular, the study finds that there is a rise in trade protectionism. The majority of trade protectionist measures are in the form of reshoring policies indirectly impacting China, although investment restrictions are also clearly on the rise. (Figure 2).

The rising global protectionism disproportionately impacted strategic sectors, such as semiconductors, in China and was more pronounced in China’s most developed provinces—Shanghai, Zhejiang, Jiangsu, Guangdong, and Beijing. Historically, these provinces attracted the most foreign capital but experienced the sharpest downturns from 2018 to 2022.

Our research indicates that although the United States has implemented the largest share of trade protectionism measures according to data from the Global Trade Alert Database, a broader increase in global protectionism is the primary driver behind the sharp decline in foreign direct investment (FDI). This trend suggests that escalating trade protectionism extends beyond US-China competition and is attributed to the broader rise in global protectionism.

Particularly, the majority of protectionist measures originate from reshoring initiatives that do not directly target China and, in principle, would impact all other countries in the world. Consequently, this suggests that these reshoring measures are poised to substantially affect FDI in various developing nations as well. Our findings suggest that unchecked trade protectionism could trigger a cascading effect, leading to a more fragmented global economy. This fragmentation would likely result in substantial negative spillovers, adversely affecting many countries beyond the primary focus of these policies.

Although rising global protectionism hinders FDI inflow to China, it is not the sole reason for the drastic decline. Our study finds that 45% of the 60 percentage point drop in FDI can be attributed to internal changes within China. While the specific causes of these internal changes are beyond the scope of this study, it also suggests that it is crucial for policymakers to implement targeted policies to address these changes, to ensure a more stable and attractive investment environment.

In conclusion, the substantial decrease in greenfield FDI in China from 2018 to 2022 highlights the roles of global trade protectionism and internal factors within China. While external protectionist measures significantly contribute to this decline, internal dynamics within China also play a substantial role. Addressing these challenges requires a nuanced approach, with targeted policies to mitigate the effects of both global protectionism and internal shifts. This strategic focus will be vital for stabilizing China’s investment climate and ensuring its attractiveness to foreign investors in the face of evolving global economic landscapes.

By HUANG, Yijia

Researchers: LU, Weilin, YI, Xin