Summary:

Semiconductor devices are structured into four market segments:

1. Integrated Circuits (ICs) (commonly known as ‘chips’) are the ‘brains’ of an electronic device that process and store information. Our smartphones and laptops can store pictures and run apps due to these miniature chips. They are also the brains that power automobiles, powering everything from GPS navigation to gear shifting and emissions.

2. Optoelectronics are devices that deal with light and power our smartphone screens and cameras. They are found in our television OLED screen displays, for example.

3. Discretes are basic, single-function on/off electronic parts like power switches, found in almost all electronic devices.

4. Sensors & Actuators are devices that detect and respond to changes in the environment. Found in devices like fitness trackers, car airbags, and automated doors, sensors ‘sense’ the changes and actuators ‘act’ on them. For example, they tell our car’s airbags when to blow up.

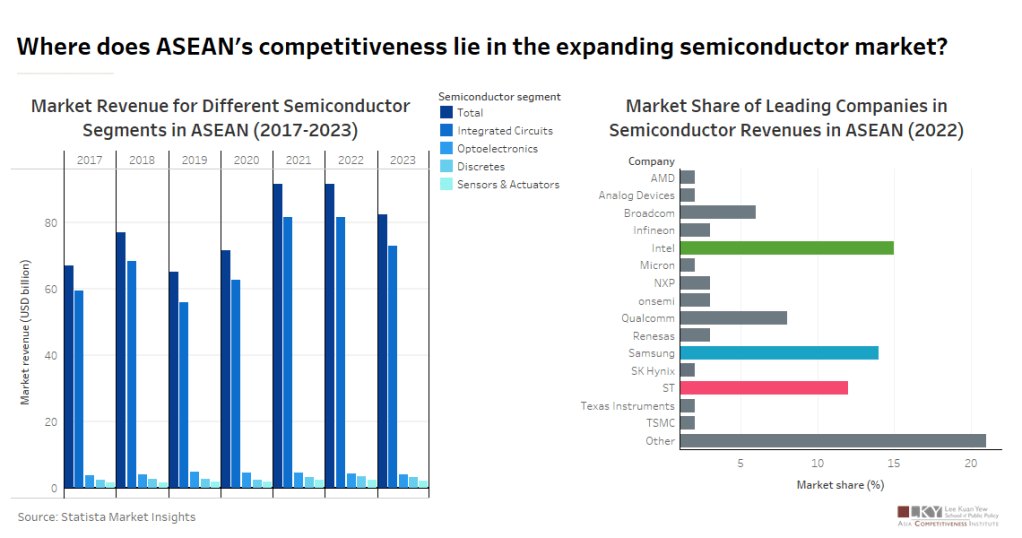

Semiconductors are the most strategic and geopolitically-sensitive component in the world, notorious for starting the chip wars between the US and China. What does ASEAN’s semiconductor market structure look like? This is depicted in the first chart – that ICs command the highest market revenue in ASEAN’s semiconductor space is patently visible. But these trends are true worldwide. Then what makes the dominance of ICs in ASEAN stand out? Firstly, ASEAN’s share of global IC assembly and testing is disproportionately large, centered in Malaysia, Singapore, Vietnam, and the Philippines. Secondly, Vietnam is one of the leading assemblers and exporters of smartphones (that require advanced ICs), while Thailand, Indonesia, and Malaysia are automotive manufacturing giants, heavily concentrating the demand for automotive ICs within the region compared to more dispersed production elsewhere.

Regarding the other three segments, specifically optoelectronics, their manufacturing is heavily concentrated in China, South Korea, and Japan – leading to a small ASEAN presence. Then, discretes, for instance, is a highly competitive segment with multiple players across Asia and the world, leading to thin profit margins and depressed selling prices, squeezing out revenues for ASEAN players. Finally, most R&D in front-end sensors & actuators are localised in the US, Europe, Japan or South Korea.

The second chart shows the major companies making up the semiconductor revenues in ASEAN. Intel, Samsung, and ST are deep-rooted in ASEAN’s semiconductor ecosystem. They capture 15%, 14%, and 12% of ASEAN’s revenues, leaving behind other competitors like AMD, Analog Devices, Micron, and SK Hynix. The three companies operate extensive manufacturing and assembly facilities – for instance, Intel has large-scale plants in Malaysia and Vietnam, while Samsung’s investments in Vietnam’s smartphone and chip assembly have skyrocketed its revenue. ST covers a range of sectors, mainly automotive ICs, equipping Thailand’s and Indonesia’s automotive and EV sectors.

Highlights:

1. ASEAN’s semiconductor market revenue is dominated by ICs that consistently make up over 85% of total market revenue due to the large presence of IC assembly and testing facilities, majorly in Vietnam, Malaysia, Singapore, and the Philippines.

2. The region’s demand for ICs mainly stems from Vietnam’s booming smartphones market, and Indonesia, Thailand, and Malaysia’s strong automotive sector.

3. Intel, Samsung, and ST constitute the highest revenue shares in ASEAN, attributed to Intel’s large-scale plants in Malaysia and Vietnam, Samsung’s heavy investments in Vietnam, and ST’s automotive IC presence.

Article & Graphic By BALAJI, Akshaya