The year 2023 was punishing for startups worldwide – cash-strapped and caught in a funding freeze due to cautious investors, multiple startups declared bankruptcy and shut down. Besides, high interest rates (to control the high inflation rates in the post-pandemic world) and geopolitical uncertainty – intensified by the Silicon Valley Bank collapse – added fuel to the fire. However, a recent study by researchers at the Asia Competitiveness Institute (ACI) has found that while Indian startups were also affected by the global funding winter, the startup ecosystem displayed high resilience, and there is considerable heterogeneity in the spread of startups across industries, regions, and subnational economies.

A major driver of innovation and investments into India’s startup landscape is the Startup India Initiative of 2016 whose comprehensive policies covered crucial areas such as providing entrepreneurs with financial assistance, avenues for mentorship, recognition, innovation training and incubation, and ease of operation by way of relaxed regulatory reforms. Furthermore, the government has displayed heightened interest in promoting lower-tier cities and lesser competitive subnational economies as suitable startup hubs, besides the well-cemented locations in Karnataka, Maharashtra and Delhi. This has helped Tier 2 and 3 cities catch up to their Tier 1 counterparts in startup growth and funding.

Next, concerning industrial specialisation, the rate of startup proliferation has been promising in frontier industries like Green Technology and Renewable Energy, two of the eight key industries crucial to realising the Viksit Bharat 2047 ambition (the government’s vision to transform India into a US$30 trillion developed nation by its 100th year of independence in 2047) as identified by the authors.

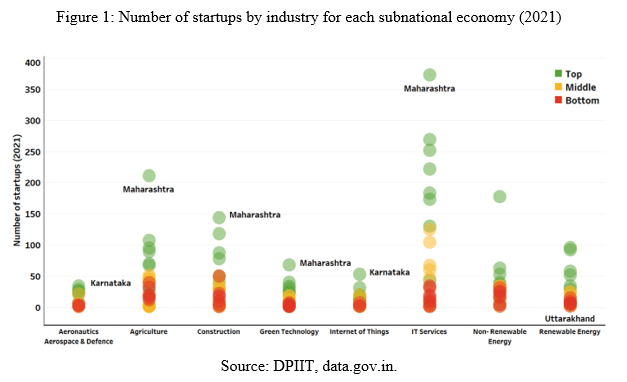

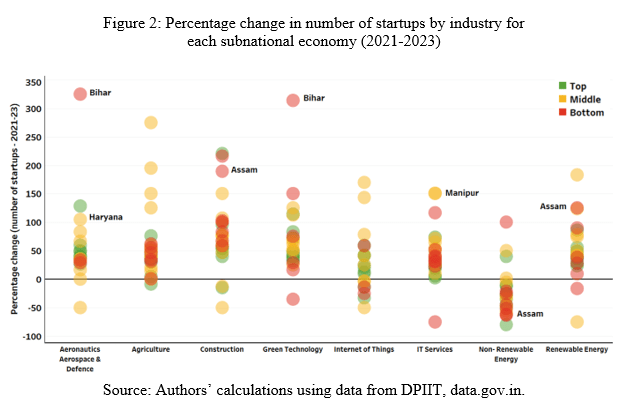

Plotting the startup trends in these key industries at the state level revealed that, while the Top subnational economies like Maharashtra and Karnataka have a large base in terms of startup numbers in 2021, they are surpassed by Middle- and Bottom-ranking states (as per ACI’s Competitiveness Index) like Bihar, Haryana and Assam in post-pandemic startup growth from 2021 to 2023 (Figures 1 and 2).

This redistributive transformation of the Indian startup ecosystem in favour of the Middle- and Bottom-ranking states is also evident in the context of funding; Middle- and Bottom-ranking states display elevated startup funding levels in the Seed and Series-A rounds (ideation and early stages). Such states are mostly emerging/aspiring startup hubs, hosting more upcoming or newly established startups that require considerable early-stage funding than those in Top-ranking subnationals.

Diving deeper into the successes of the Middle- and Bottom-ranking subnationals, two frontrunners emerge – Haryana and Bihar. The former’s success stems from its abundant land supply and its proximity to Delhi; The seamless connectivity between Gurugram in Haryana and Delhi lets the former benefit from the latter in terms of legal procedures for setting up a new business. Bihar’s growth, on the other hand, is driven by progressive state policies promoting green energy, including a pioneering climate strategy, an encompassing EV policy, and widespread ethanol plant development, making it an aspiring hub for green industry startups.

The Indian startup ecosystem is witnessing a shift, with the massive rise of startups in lower-tier cities and less-competitive subnational economies. However, challenges like resource mismanagement and unsustainable business models continue to threaten this development. Therefore, it is imperative that these problems are addressed to ensure that startup growth in emerging hubs does not stagnate.

Researchers: Akshaya BALAJI, GEORGE, Ammu