ASEAN’s digital economy is projected to increase to US$600 billion by 2030, which is nearly tripling its value in 2023.[1] A recent ACI study found that ASEAN countries have attracted more digital economy-related cross-border venture capital investments than the rest of the world. Digital economy-related VC deals make up over 71% of VC deals in ASEAN – the level of VC investment concentration in the digital economy has surpassed that of the global average. In addition, ASEAN’s growth rate in digital economy investment is over three times the global average in 2023. This underlines the potential of the digital sector to drive investment and growth for economies in the region.

The study starts by asking about ASEAN and member states’ positions in the global digital economy investment. It was found that ASEAN had received the highest proportion of digital economy investments globally from 2020 to 2023. This is not driven by a single country of the ASEAN-6 (Singapore, the Philippines, Malaysia, Thailand, Vietnam, and Indonesia), but all of them demonstrated a higher than global average attractiveness in digital economy investments from 2020 to 2023, though Singapore is far ahead of the other five countries.

Regarding ASEAN’s leading investment partners, the period from 2010 to 2023 saw increasing diversification of ASEAN’s investment partners. The investment ties between the ASEAN and the two largest economies, the US and China, have loosened and are being partially replaced by the many smaller countries and economies that make up the EU and the OECD. Non-Asian economies have become the leading investors in the region’s digital economy in recent years. Although Asian countries are no longer the leading investing countries, ASEAN still makes up a large share of their investment portfolio, representing these neighboring countries’ preference for investing in the region, potentially driven by geographic proximity and cultural ties.

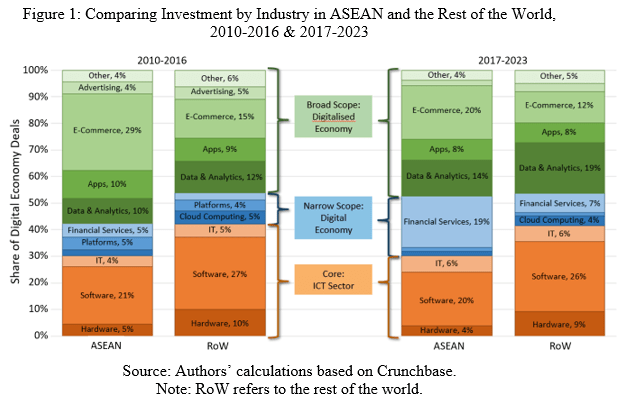

In terms of what industries in the digital economy are more attractive to cross-border VC investment in the ASEAN, Figure 1 shows that e-commerce accounts for a larger share of the region’s VC investment in digital economy, a share nearly twice as high as the rest of the world in both time periods. Notably, in recent years, financial services and data analytics related digital industries have expanded. VC investments in digital financial services accounted for almost 20% of ASEAN’s total deals, compared to only 7% in the rest of the world. However, across both time periods, investments in the core ICT sector, including hardware, software and IT, accounted for a lower share of the total investment in ASEAN compared to the rest of the world, driven by lower investments in the software and hardware industries.

Despite relatively good performance in attracting digital economy investment, challenges remain hindering ASEAN’s future growth in the industry – especially in terms of restrictive digital policies. Except for the Philippines and Singapore, ASEAN-6 countries displayed a higher than world average level of restrictiveness for digital policies, with Indonesia as the most restrictive, ranking 4th out of 64 countries according to the latest available Digital Trade Restrictiveness Index (DTRI). The index evaluates the barriers faced by firms, especially foreign entities, arising from digital trade policies such as restrictions to cross-border data transfers, online sales restrictions, or foreign investment restrictions in certain digital economy industries. The pattern remains similar if we delve into data policies. Our study shows that a more restrictive digital policy environment is associated with a lower investment attractiveness of a country’s digital economy in a global comparison. The negative relationship between the restrictiveness of data policies and investment attractiveness in highly data-dependent industries, such as cloud computing, holds stronger for ASEAN than for the rest of the world.

The good news is that most ASEAN-6 countries have updated their cross-border data flow policies over the past five years, moving toward less restrictive frameworks and greater harmonization. For example, to allow for more flexibility in cross-border data transfers, Indonesia’s new Personal Data Protection Law, removed many data localization requirements, and Thailand has provided more and clearer compliance options for businesses while also aligning more closely with EU data protection standards, facilitating business with this major economy.

To further attract financial flows into digital sectors and technologies, ASEAN countries should prioritize reducing barriers to data flows and digital trade while balancing the need for individual rights and national security. Harmonizing digital policies across the region could significantly improve the investment climate, enabling firms to leverage the regional market more effectively. The ASEAN Digital Economic Framework Agreement presents a valuable opportunity to streamline policies, reduce barriers, and foster innovation and investment.

By HUANG, Yijia

Researcher: LIU, Jingting, SENGSTSCHMID, Ulrike

[1] Google, Temasek, and Bain & Company. 2023. ‘E-Conomy SEA 2023: Reaching New Heights: Navigating the Path to Profitable Growth’. https://www.temasek.com.sg/content/dam/temasek-corporate/news-and- views/resources/reports/google-temasek-bain-e-conomy-sea-2023-report.pdf.