Turbulent geopolitics defined by trade wars, regional conflicts and pandemic-induced disruptions, prompted the US and other Western nations to diversify their supply chains away from China, a domineering presence in supply chains across numerous sectors, especially high-tech sectors critical for national security. This ‘de-risking’ strategy has boosted ASEAN’s global trade and economic activities. However, a recent study by researchers at the Asia Competitiveness Institute (ACI) has found that despite making significant gains in exports and successfully attracting foreign investment in high-tech products, the ASEAN-6 remains heavily reliant on Chinese high-tech imports. This suggests that the US is still indirectly linked to China’s economy via the ASEAN-6, casting doubt on the effectiveness of the de-risking strategy.

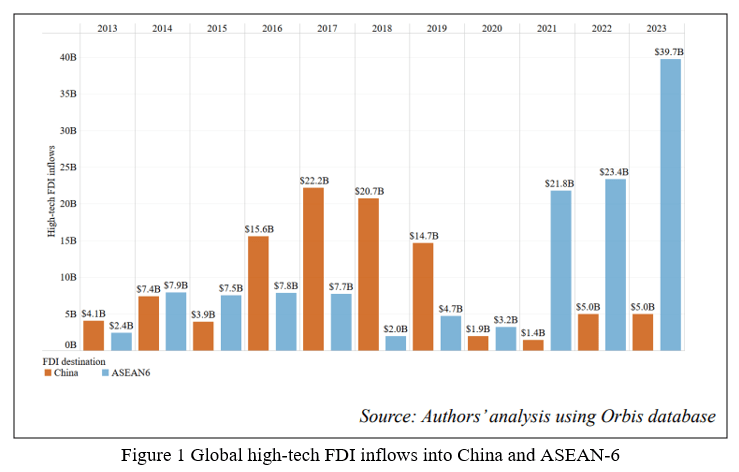

ASEAN-6 has benefitted considerably from the US-led supply diversification efforts – Vietnam and Malaysia have recorded an impressive improvement of their share in the US’s high-tech imports, especially from 2019 to 2021. The strategy also shifted investors away from China towards the ASEAN-6, with Malaysia, Singapore and Vietnam accounting for the bulk of high-tech FDI inflows. This indicates that Southeast Asia is viewed as a stable destination for high-tech investment at a time when geopolitical tensions and supply chain disruptions reign over global trade (Figure 1).

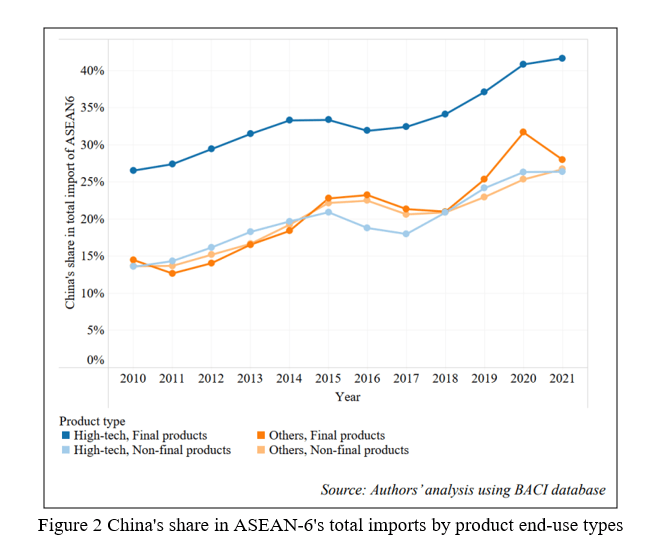

But these gains must be perceived with a grain of salt. Notwithstanding the evident decline of the US’s dependence on China amidst global supply chain restructuring, the West’s engagement with Chinese business persists in an indirect manner, through Southeast Asian countries. China’s ironclad influence on the ASEAN-6 economies is exemplified by close trade relations forged through the ASEAN-China Free Trade Agreement (ACFTA), the Belt and Road Initiative (BRI), and the Regional Comprehensive Economic Partnership (RCEP). As a result, China’s market share in ASEAN-6 imports of high-tech final product increased from 27% to 41% from 2011 to 2021 (Figure 2). Furthermore, much of the upswing in the bloc’s high-tech exports arise from the rebranding and transshipping of Chinese goods – raising questions on the value-add of ASEAN-6 in high-tech global trade.

Also signaling deeper integration, from 2021-2023, China has funneled large investments in high-tech manufacturing facilities in the ASEAN-6, specifically in Vietnam and Malaysia. While gainful in the short-term, high reliance on Chinese investment imperils ASEAN-6’s long-term economic resilience, affecting its capacity to handle global shocks.

In this complex geopolitical landscape, the ASEAN-6 nations tread a fine line. ASEAN-6’s deep links with China in the backdrop of the de-risking strategy underscores the importance of neutrality and balance in relations with the US and China, which the ASEAN-6 has demonstrated through its pragmatic approach of expanding economic activities with countries from the US and China blocs.

Researchers: YAN, Bowen, BANH, Thi Hang