Summary:

Japan has long been a focal point in discussions about monetary policy and economic stagnation. The country’s battle with deflation and economic stagnation has been deeply rooted in the liquidity trap, a condition where monetary policy becomes ineffective because nominal interest rates are already at or near zero, and savings still exceed investments.

The liquidity trap concept was vividly observed in Japan during the 1990s and early 2000s, a period often referred to as the “Lost Decade.” Despite aggressive monetary easing and fiscal stimulus, the Japanese economy struggled to escape deflationary pressures. Interest rates were slashed to near-zero levels, yet consumer spending and investment remained sluggish. This phenomenon challenged traditional economic theories and posed significant dilemmas for policymakers.

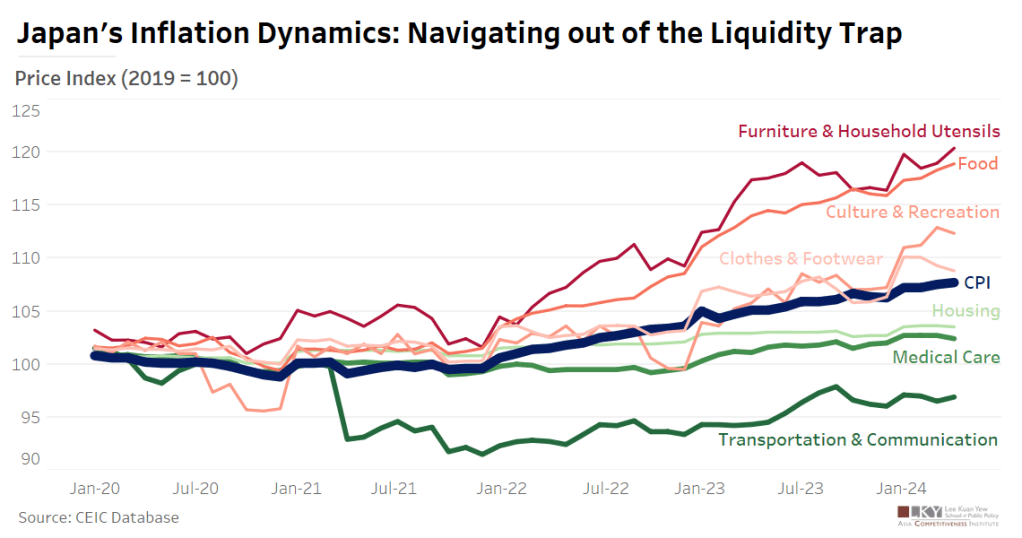

In the post-pandemic period, the recent trends in Japan’s Consumer Price Index (CPI) from January 2020 to January 2024, as illustrated in the figure, offer a fascinating glimpse into the country’s ongoing economic journey. The chart indicates a steady upward trend in the overall CPI, suggesting that Japan might be seeing a gradual exit from its deflationary trap. At the same time, the Bank of Japan also announced a positive interest rate target, indicating its intention to normalize the monetary policy.

Key observations from the data include:

- CPI (Consumer Price Index): The CPI shows a consistent increase, highlighting a general rise in consumer prices after the COVID-19 pandemic. This is a significant shift from the prolonged period of stagnant or falling prices that characterized Japan’s economy in previous decades.

- Food Prices: Food prices in Japan exhibits substantial volatility but an unmistakable upward trajectory, particularly from mid-2022. This rise could be attributed to both global supply chain disruptions and domestic factors such as changing consumption patterns.

- Housing and Medical Care: These categories show relatively stable yet slightly increasing price trends. The stability in housing prices contrasts with more volatile sectors, reflecting perhaps more regulated or less elastic supply and demand dynamics.

- Clothes & Footwear and Furniture & Household Utensils: Prices in these categories indicate moderate but consistent price increases. This could signal rising production costs or a shift in consumer preferences towards higher-quality or higher-priced goods.

- Transport & Communication: These prices show significant volatility, which could be due to fluctuating fuel prices, technological advancements, or changes in consumer behavior post-pandemic.

- Culture & Recreation: The price shows a general increase, reflecting increased spending on leisure activities as economic conditions improve and consumers regain confidence.

The price trends suggest that Japan is experiencing a phase of inflation, albeit modest, compared to the deflationary pressures of the past. This inflationary trend is crucial for the country as it seeks to invigorate its economy and avoid slipping back into a liquidity trap.

In conclusion, Japan’s current economic trajectory, as reflected in the CPI trends, provides a cautiously optimistic outlook. The rise in prices across various sectors indicates a departure from the deflationary spiral of the past, offering hope that Japan can sustain positive inflation and thereby enhance economic growth.

Highlights:

- Japan’s overall consumer price index is on the rise.

- Prices of consumption goods, such as food, are leading the increase in overall prices.

- Transport, housing, and medical care remain relatively affordable in Japan.

Article By Xie Taojun

Graphic By GE, Yixuan