The Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) has been effective since December 2018. It includes a comprehensive chapter on investment that provides improved stability, transparency, and protection for investors and their investments in member countries. This chapter also safeguards the members’ right to regulate investments in the public interest. Such provisions foster a conducive environment for foreign direct investment (FDI) by deregulating non-sensitive and fast-growing market sectors. For example, Australia, Canada, and New Zealand have raised the investment screening threshold for private investments by CPTPP investors in non-sensitive sectors, while Vietnam has liberalized its mining sector to attract investments from fellow CPTPP members.

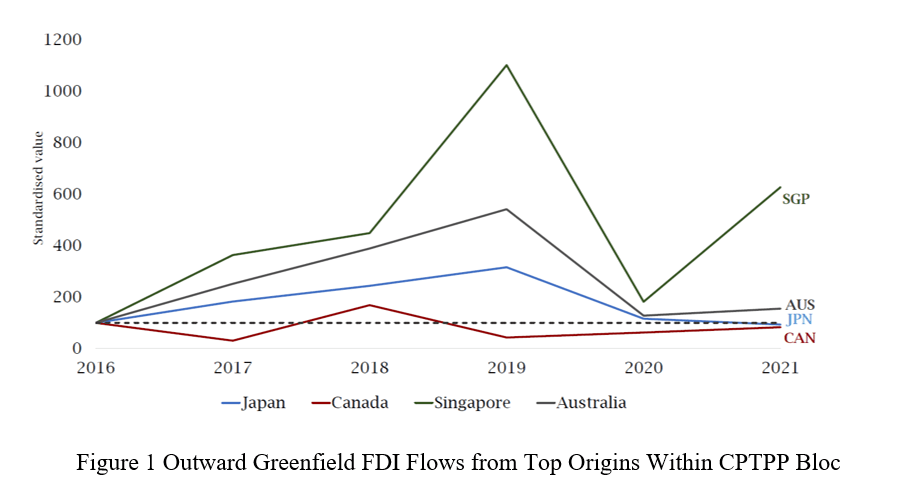

Using FDI data from 2015 to 2021, a study by ACI explores the dynamics of FDI inflows to the CPTPP, with a particular focus on greenfield FDI before and after the CPTPP’s implementation. It finds that FDI within the CPTPP has increased by 18.9% since its implementation, primarily fueled by investments from Japan, Singapore, Australia, and Canada. Notably, Japan stood out for having the most substantial bilateral FDI relationship with all other CPTPP parties. Concurrently, Singapore’s FDI within the bloc exhibited resilience despite the COVID-19 pandemic. As Figure 1 shows, Singapore is the only economy registering a strong V-shaped recovery in FDI to CPTPP members in 2021, particularly notable in the manufacturing and ICT sectors.

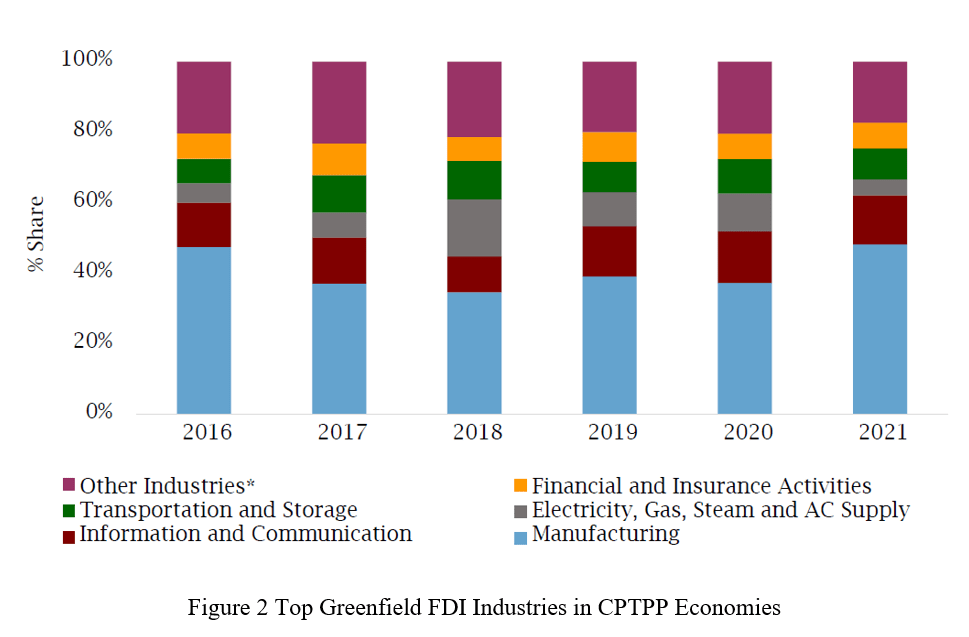

By modes of entry, from 2016 to 2021, FDI inflows to CPTPP economies were dominated by greenfield FDI, where investors built new productive units from the ground up. More than 80% of the FDI inflows to CPTPP destinations like Vietnam, Mexico, and Peru involved greenfield FDI. Despite the initial shock of COVID-19, most CPTPP economies experienced a solid rebound in FDI after the first year of the pandemic. This was driven by the reopening of regional economies and the resumption of industrial activities in sectors such as manufacturing and those that rely heavily on global value chains, i.e., GVC-intensive industries. The top five industries in attracting FDI in the CPTPP bloc are manufacturing, financial and insurance activities, information and communication, electricity, gas, steam and air conditioner supply and transportation and storage (Figure 2). These top five sectors have accounted for more than 80% of the total FDI inflows to CPTPP since 2016.

Applying a difference-in-difference framework to bilateral FDI data, the study finds evidence of investment creation within member economies after the implementation of CPTPP. In other words, the growth in FDI originated from within the bloc. The creation effect is notable in sectors like wholesale trade, accommodation and food services, manufacturing management of companies and enterprises and other services. Despite COVID-19, investment flows to the manufacturing sector have proven resilient and were expected to drive the post-pandemic recovery of FDI inflows to the CPTPP bloc.

The investment creation effect of CPTPP underscores the importance of free trade agreements, particularly amid rising geopolitical tensions such as the US-China trade war, the Russia-Ukraine war, and other protectionist measures. Such agreements play a vital role in enhancing economic resilience through strong FDI linkages, especially in the face of global shocks.

By HUANG, Yijia

Researchers: VAID, Rohanshi and GEORGE, Ammu