Summary:

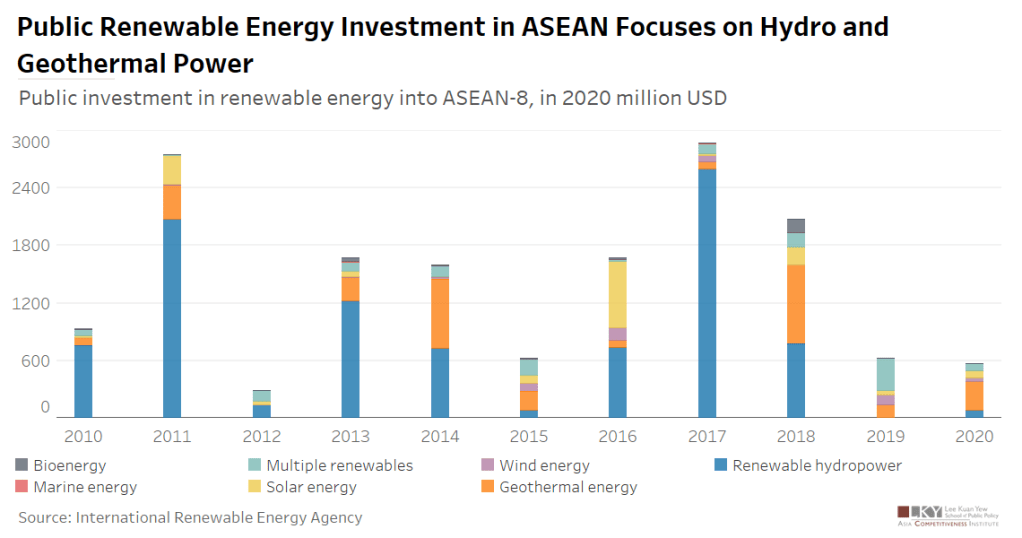

Public investment in renewable energy is a key enabler for ASEAN to achieve its renewable energy ambition — 23% of renewable energy in its total primary energy supply by 2025. From 2010 to 2020, the public investment inflow into renewable energy in ASEAN had been fluctuating. The number peaked at 2.85 billion USD in 2017. Yet, the investment plunged in 2019 and 2020, with a significant drop from four out of the top five public investors, China, Japan, Asian Development Bank and Germany.

Highlights:

- Public investment in renewable energy in ASEAN predominantly targets renewable hydropower and geothermal power, constituting roughly 80% of the total investment. Between 2010 and 2020, renewable hydropower received $9.2 billion USD, while geothermal power received $3 billion USD.

- The investment appeal of hydropower and geothermal power stems from the region’s abundant hydro and geothermal resources. The International Hydropower Association indicates that Myanmar could harness around 100 GW of exploitable capacity, with Indonesia, Malaysia, and Laos collectively boasting a technical hydropower potential of approximately 120 GW. Additionally, Indonesia hosts 40% of the world’s geothermal energy.

- On the other hand, public investment in bioenergy, wind power and marine energy had been limited from 2010 to 2020. In total, investment in the three sectors accounted for less than 5% of the total investment during the decade.

Article By HUANG, Yijia

Graphic By GE, Yixuan

Note:

1. ASEAN-8 includes Cambodia, Indonesia, Laos, Malaysia, Myanmar, Philippines, Thailand, and Vietnam. Data for Brunei and Singapore is not available in the dataset. International Energy Agency’s data shows that renewable energy sources accounted for less than 1% of Brunei and Singapore’s total primary energy supply.

2. The dataset only records public investment from foreign public institutions such as the Ex-Im Bank of China and Japan Bank for International Co-operation and international organisations, such as the Asian Development Bank and International Finance Corporation. Investment from domestic public institutions is not included in the dataset.