India’s rise to becoming a global leader in digital payment transactions is a remarkable story of transformation and innovation. Accounting for 46% of global real-time payments, India saw a 50% increase in such transactions in less than eight years, with the total digital payment transactions reaching USD 1 trillion in 2022. This figure is particularly notable as it constitutes a third of India’s GDP. The country’s achievement is even more impressive considering its status as the most populous nation in the world and the significant disparities in digital infrastructure across its regions. What lessons can other developing countries learn from India’s experience?

The success of India’s digital payment landscape can be attributed to several key factors. Government initiatives such as the Digital India programme played a pivotal role in enhancing digital infrastructure. Additionally, the private sector made significant contributions, notably through Reliance’s Jio network, which drastically reduced data prices, making mobile data in India among the cheapest globally at just 0.17 USD per 1GB.

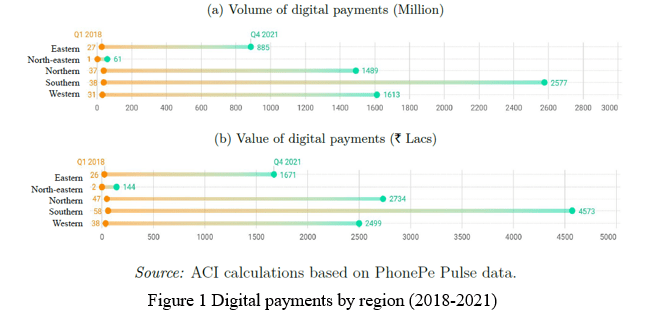

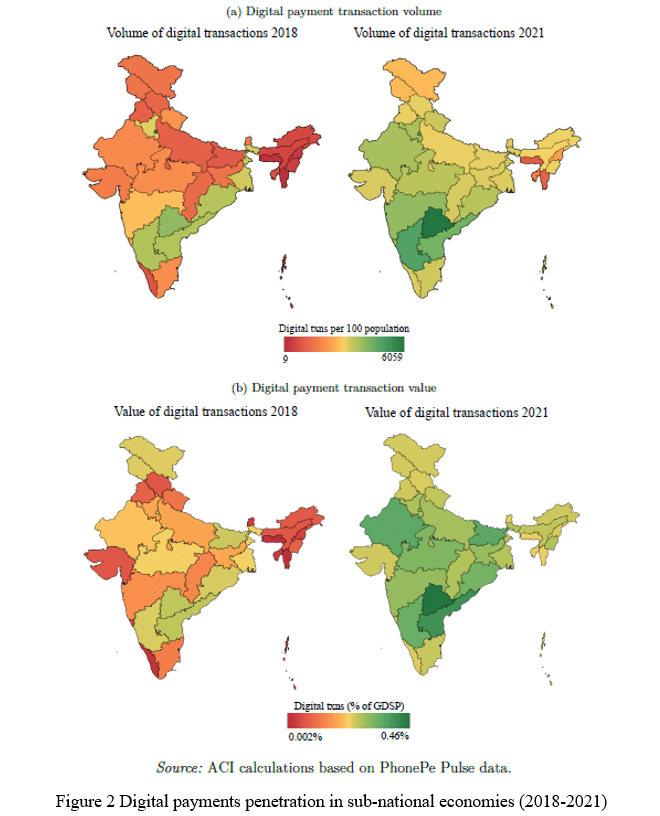

While there has been a notable increase in digital payments at the national level in the past three years, the adoption rates vary significantly across different regions. This variation is clearly depicted in Figure 1, which shows that the Southern and Western regions of the country have seen substantial growth in digital payments, in contrast to other regions which have progressed more slowly. Figure 2 further highlights the uneven distribution of digital payment penetration across India. Regions like Telangana, Karnataka, Andhra Pradesh, Delhi, and Maharashtra are leading, with the highest number of transactions per 100 people, whereas Jammu & Kashmir, Mizoram, Meghalaya, Tripura, and Nagaland are noticeably trailing behind.

The authors identify several factors contributing to this uneven performance. Key among these are the inadequate infrastructure for supporting digital transactions in certain regions, the complexity of user interfaces in digital payment systems, and the language barrier in mobile payment applications, which hinders familiarity and ease of use for many users. These elements collectively impact the overall effectiveness and adoption of digital payment systems in various parts of the country.

The paper then sheds light on effective practices in various sub-national regions that can serve as a model for promoting digital payment adoption. A standout example is the Bank Correspondent (BC) Model, which has been instrumental in driving digital payments and enhancing financial inclusion, especially in rural areas. This model, exemplified by the work of Bank Sakhis, acts as a bridge between banks and customers in rural areas with limited access to formal banking. These correspondents provide basic banking services and crucial education about digital payments. Their role became even more critical during the COVID-19 pandemic, facilitating digital transactions and supporting rural income stability by ensuring access to the Direct Benefit Transfers (DBT). Notably, Bihar and Odisha, despite being among the least digitally competitive regions, witnessed a significant surge in digital payments during the pandemic, thanks to this model.

In conclusion, this paper highlights India’s significant shift towards digital payments during the COVID-19 pandemic, moving from a cash-based economy and revealing regional disparities in digital adoption. Despite low pre-pandemic digital competitiveness, states such as Bihar and Odisha saw a surge in digital transactions, largely due to the Bank Sakhi program which effectively bridge the digital divide and empower local communities with essential banking services. This revolution in digital payments demonstrates India’s success domestically and sets the stage for its growing influence and collaboration internationally, symbolizing a transformative step towards a globally connected, digitally empowered future.

Researchers: VAID, Rohanshi, GUPTA, Shubhangi and GEORGE, Ammu