Summary:

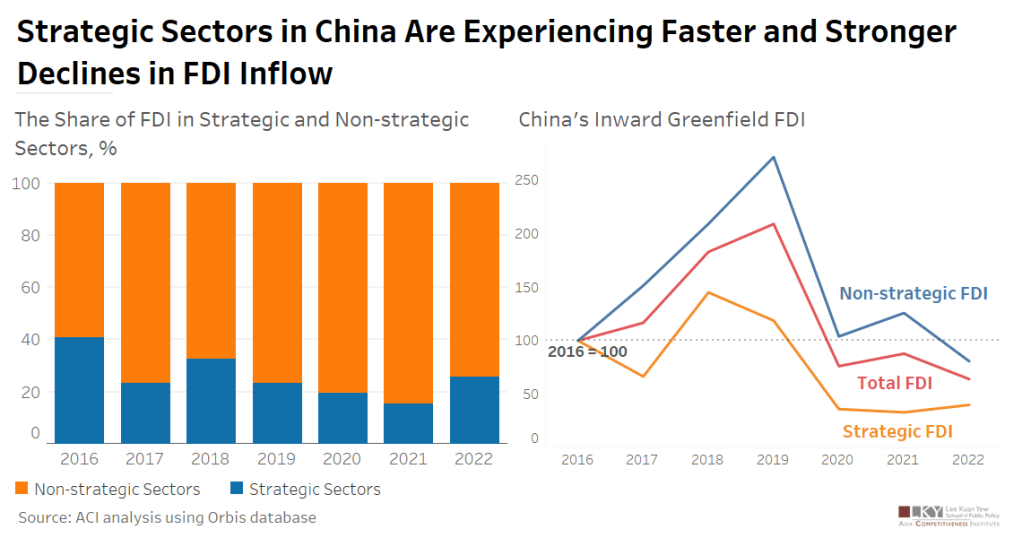

Foreign Direct Investment (FDI) inflows into China have experienced significant fluctuations in recent years, influenced by geopolitical tensions and supply chain disruptions. These changes have particularly impacted strategic and non-strategic sectors differently, as seen in Greenfield FDI trends since 2016.

Strategic sectors experienced a more rapid and severe decline in inward FDI. Key areas like semiconductors, telecommunications, 5G infrastructure, clean tech, pharmaceuticals, and critical minerals, which are vital for national and economic security, began to see a downturn with the start of the US-China Trade War. This decline was further exacerbated by the COVID-19 pandemic. On the other hand, non-strategic sectors, accounting for the majority of greenfield FDI, witnessed a steady increase until the pandemic, after which they too faced a significant downturn.

Highlights:

- The flow of Foreign Direct Investment (FDI) into China, primarily in non-strategic sectors, maintained a growth trend before the outbreak of COVID-19. However, it experienced a sharp downturn during the pandemic.

- The decline of FDI in China’s strategic sectors has started earlier and seen a decrease since the beginning of the US-China trade war, with the COVID-19 pandemic further intensifying this downward trend.

- From 2016 to 2022, the proportion of FDI in China’s strategic sectors has been consistently decreasing, indicating that disruptive events have had a disproportionately greater impact on these sectors.

Article By LU, Weilin

Graphic By GE, Yixuan