It has been long suspected, studied, and proven that a country’s domestic monetary condition is influenced by global financial cycles. The US Federal Reserve raised its policy rate ten consecutive times between March 2022 and May 2023, bringing the US interest rate to the highest level in over a decade. Higher US interest rate typically means higher financial market risk, which stalls investment flows. Emerging markets may be especially prone to such fluctuations. A study by ACI finds that indeed, US interest rate and global financial risk hikes have a sizable negative impact on emerging countries’ real economy. It further examines how the negative effect is transmitted to the emerging countries.

Focusing on 26 emerging market economies, three facts are documented:

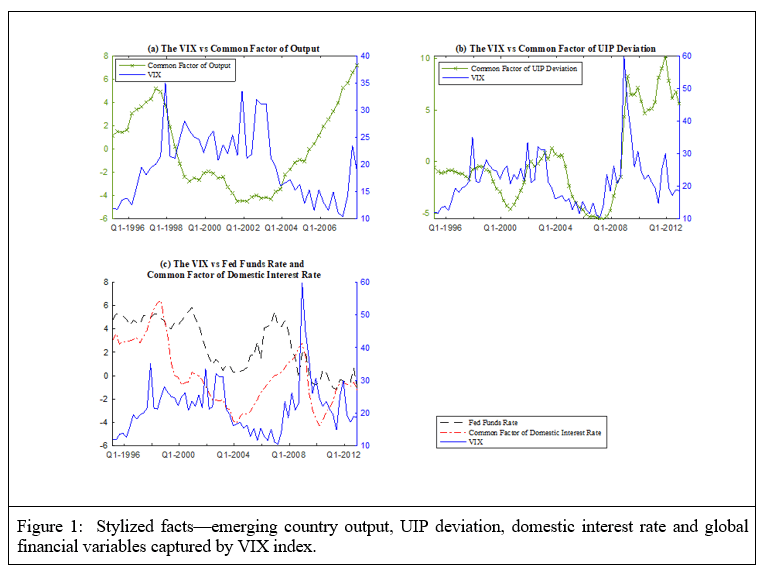

- Periods of high financial market risk captured by the VIX index coincide with periods of low output in the emerging countries. See plot (a) in Figure 1.

- Both emerging country domestic interest rates and the US Federal Funds rate are negatively correlated with global financial risk. This reflects central banks lowering interest rates, which are firms’ key borrowing costs, in countering financial market downturns. See plot (c) in Figure 1.

- Uncovered interest parity (UIP) deviation – the difference between emerging country interest rate and US interest rate unaccounted for by expected exchange rate changes – moves with global financial risk in tandem. See plot (b) in Figure 1.

Formally, the study quantifies the impact of contractionary US monetary shocks and global financial risk shocks on emerging countries’ real output and investment. It was found that after the global financial risk goes up by one standard deviation, real output and investment of emerging countries contract by about 0.5% and 1.8%, respectively. The contractions are 0.1% and 1% after a one standard deviation increase in US interest rate. Notably, the gap between the financing costs in the emerging countries and the US measured by the UIP deviation contributes to this transmission.

When global financial risk is high – either due to an initial US rate hike or other financial market disturbances – US interest rates eases (meaning decreases) by a large margin while emerging country interest rates remain high, reflecting tight monetary conditions in the emerging countries: high financing costs, lack of available funds, etc. The higher financing costs in emerging countries relative to the US are captured by the higher UIP deviation when global financial risk is also high.

In a counterfactual analysis, we show that had UIP deviation not responded to global financial risk, the fluctuations in emerging countries’ GDP due to global financial risk shocks would have been reduced by half.

Two factors may have contributed to the higher emerging country interest rate relative to the US in high financial risk periods: First, it may be due to emerging countries being more conservative in changing their monetary policy stance. For instance, when global financial risk heightens, an emerging country hoping to stimulate the economy by resorting to an expansionary monetary policy may be more constrained to do so out of concern that a lower interest rate could further encourage capital outflows. Second, it could be that emerging country central banks are as aggressive as the Federal Reserve in setting their policy rates, but imperfect monetary policy transmission causes the market rate at which domestic banks borrow to be affected by global financial risk conditions. The study shows that the first factor is the driving one.

The policy implication follows that emerging countries need to build up foreign reserves and buffers to create policy room for effectively easing monetary conditions when global financial market conditions turn unfavorable.

By LIU, Jingting and GUPTA, Shubhangi

Researchers: LIU, Jingting, ALBA, Joseph Dennis, CHIA, Wai Mun